-

20+ Years in the Wanneroo Realty Market

20+ Years in the Wanneroo Realty Market -

150+ Managed Properties

150+ Managed Properties -

10,000+ Residential Homes Covered

10,000+ Residential Homes Covered

News

Mortgage Broker vs Bank: Which is Best for Home Loan

The answer may not be straightforward, as choosing between a mortgage broker and a bank directly impacts your loan terms, financial flexibility, and home buying experience.

While mortgage brokers provide a wide array of loan options through their extensive network, potentially securing you favourable rates and terms, banks offer a more direct, streamlined process, without taking the time to go through an intermediary.

This article will dive into the broker versus bank debate including revealing the pros and cons, services, and critical factors you need to consider. Armed with this knowledge, you’re in a better position to make a well-informed decision that helps your home loan strategy match with your financial goals, helping you reach a successful homeownership.

Contents

What is a mortgage?

A mortgage is essentially a loan for purchasing real estate, with the property itself serving as security for the loan. It facilitates homeownership through repayable instalments, covering both the principal amount borrowed and the accrued interest.

Types of Mortgages:

- Fixed-rate Mortgage: Interest rate stays the same, ensuring predictable monthly payments.

- Adjustable-rate Mortgage (ARM): Interest rate changes based on market conditions, affecting payments.

- Interest-only Mortgage: Only interest is paid initially, with principal payments later.

How do mortgage brokers work?

Mortgage brokers serve to connect you with lenders, aiming to find the best mortgage options available. They take care of the paperwork, negotiate terms, and strive to secure the most advantageous loan conditions on your behalf. The expertise and connections of brokers often result in better deals for you.

Step-by-Step Process:

- Assessment: Your financial situation is evaluated by the broker, considering your income, debts, and credit score.

- Search: The broker searches their network of lenders for loan options that best match your needs, based on the initial assessment.

- Comparison: You are presented with a comparison of different loan options, where the advantages and disadvantages of each are highlighted.

- Application: The broker aids you in collecting the required documentation and submitting applications to the chosen lenders.

- Negotiation: On your behalf, the broker negotiates with lenders to secure the most favourable loan terms possible.

- Closure: After loan approval, the broker assists in facilitating the closing process, ensuring all paperwork is accurately completed.

What role do lenders play in the mortgage process?

Lenders, including banks, provide the capital you need for your home purchase. They assess your creditworthiness, financial stability, and the property’s value to determine if you’re eligible for a loan. If approved, they detail the loan’s interest rate and repayment plan. As you make repayments, lenders remain a central figure in your homeownership financial journey.

Lender’s Role:

- Credit Assessment: Lenders meticulously evaluate your credit to ascertain your loan repayment capability.

- Loan Terms: They establish the loan’s conditions, including interest rates, repayment schedules, and any specific requirements.

- Funding: Upon loan approval, lenders supply the funds needed for buying your home.

- Ongoing Relationship: Throughout the loan’s term, lenders manage payments and address any arising issues.

Knowing the roles and processes in obtaining a mortgage, from the initial search to final approval, equips you to effectively navigate home financing. Whether through a mortgage broker or directly with a bank, being well-informed ensures you can secure a loan that matches your financial aspirations and homeownership dreams.

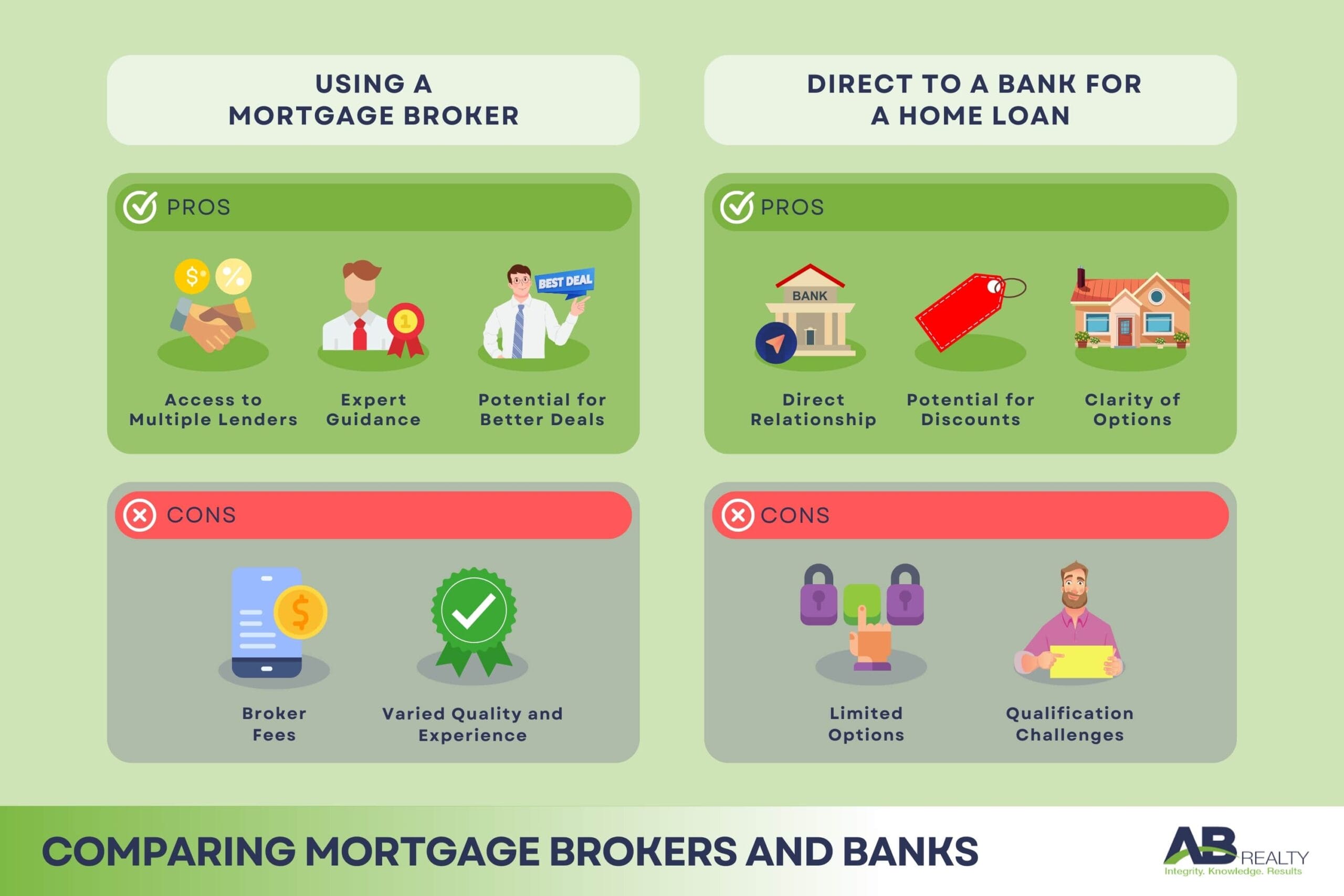

Comparing Mortgage Brokers and Banks

Your choice between a mortgage broker and a bank influences your loan’s terms, your financial flexibility, and your experience in acquiring a mortgage. Mortgage brokers offer tailored services, accessing a variety of loan options for unique financial scenarios or competitive rates. Banks present a direct home financing path with set terms, suitable for straightforward financial situations or those seeking a direct lender relationship.

Your financial situation, how you prefer to communicate, and your goals regarding loan terms guide the decision between a mortgage broker and a bank. Comprehending each option’s benefits and limitations is crucial for a choice that supports your homeownership ambitions.

Pros and cons of using a mortgage broker

| Pros | Cons |

| Access to Multiple Lenders: You get a selection of loan options from a wide lender network, tailored to your financial needs. | Broker Fees: Service charges from some brokers might increase your mortgage cost, potentially outweighing the benefits of improved loan terms. |

| Expert Guidance: Brokers offer personalised advice and manage the task of finding the best rates and terms, streamlining the mortgage process. | Varied Quality and Experience:The calibre and expertise of mortgage brokers vary, necessitating thorough research to find a skilled professional. |

| Potential for Better Deals: Brokers might negotiate terms unavailable directly to consumers, possibly saving you money over the loan’s lifespan. |

Pros and cons of going directly to a bank for a home loan

| Pros | Cons |

| Direct Relationship: A direct bank process provides a straightforward experience and clear communication, offering reassurance. | Limited Options: Banks only offer their mortgage products, which might not be as favourable as those available through a broker. |

| Potential for Discounts: Being an existing bank customer may qualify you for discounts or favourable terms based on your banking history. | Qualification Challenges: If your financial situation is unique or if your credit history is imperfect, qualifying for a bank loan might be difficult. |

| Clarity of Options: Banks simplify your choices with a concise loan product range, avoiding overwhelming options. |

Choosing between a mortgage broker and a bank

Your decision should reflect your personal needs, preferences, and financial condition. If you value a wide selection and personalised assistance, a mortgage broker might be your preferred choice. If you appreciate streamlined processes or have a robust bank relationship, direct banking could be more beneficial. Making an informed choice involves weighing each option’s pros and cons, considering your financial position and the long-term impact of loan terms.

To support your decision, here is a detailed checklist for readers to consider:

| Checklist Item | Description |

| Understand Your Financial Situation: | Assess your credit score, income, debt, and savings to determine your loan eligibility and what terms you might receive. |

| Identify Your Homeownership Goals: | Consider how long you plan to stay in the home, which might influence the type of loan (fixed vs. adjustable) you pursue. |

| Research Loan Options: | Explore different loan types and terms available through brokers and banks to understand what best fits your needs. |

| Evaluate the Level of Personalised Service: | Decide if you prefer the hands-on assistance a broker can provide, or if you’re comfortable navigating the process with a bank. |

| Consider the Costs: | Compare the costs, including interest rates, fees, and potential broker charges, to determine which option offers the best value. |

| Check for Special Programs: | Investigate if you’re eligible for any special loan programs (e.g., VA, FHA) that might be more advantageous through a bank or broker. |

Working with a Mortgage Broker

Engaging a mortgage broker connects you with a range of lenders to secure favourable terms. The process is simplified, with guidance provided at each step. You gain access to varied loan products, potentially saving on interest and cutting down administrative tasks. The key is to choose a reputable broker who meets your needs, improving your home loan experience.

Benefits of using a mortgage broker

Using a mortgage broker gives you access to numerous loan options, better terms, and a simplified application process, saving you stress and time. Often, you can secure lower rates than going directly through banks, potentially saving thousands over the loan’s life and gaining access to a broader range of lenders.

Why should you work with a mortgage broker?

Working with a mortgage broker can significantly improve the mortgage process with personalised service and better term negotiations, leading to savings and a smoother loan approval path. Many borrowers have shared success stories about brokers helping them secure loans despite financial challenges, praising brokers’ knowledge and personalised attention.

How to find a reliable mortgage broker?

To find a trustworthy broker, seek referrals, read online reviews, check licenses, and consult. The National Association of Mortgage Brokers, state licensing boards, and the Better Business Bureau are valuable resources for verifying a broker’s credibility and ensuring they align with your financial needs.

Here are some resources and directories you can use to help your search:

- NAMB: The National Association of Mortgage Brokers offers a directory of certified brokers.

- State Licensing Boards: Most states have online databases where you can verify a broker’s license and check for any disciplinary actions.

Finding the Best Home Loan Option

Securing the best home loan involves evaluating your financial health, understanding different loan types, and comparing offers from various lenders. This strategic approach aims for a loan that matches your financial situation and homeownership goals.

Factors to consider when getting a loan

As you are now about to choose a home loan, there are many important factors that need to be considered. Here’s a comprehensive list:

| Factor | Description |

| Interest Rates | Determines the cost of borrowing and affects monthly payments. |

| Loan Term | The duration of the loan, affecting both interest paid and monthly payments. |

| Fees and Penalties | Includes origination fees, closing costs, and penalties for late payment or prepayment. |

| Loan Type | Fixed-rate, adjustable-rate, or interest-only, each with its own pros and cons. |

| Credit Score | Influences eligibility and the interest rate offered by lenders. |

| Down Payment | The upfront payment affects the loan amount and possibly the need for PMI. |

| Income and Employment | Lenders assess stability and ability to repay the loan. |

| Debt-to-Income Ratio (DTI) | Measures financial health and affects loan approval and terms. |

Understanding different loan type

To better understand the different loan options available, here’s a detailed comparison table:

| Loan Type | Ideal For | Key Features | Potential Drawbacks |

| Fixed-rate Mortgage | Long-term homeowners | Predictable payments; interest rate remains the same throughout the loan term. | Higher initial interest rates compared to ARMs. |

| Adjustable-rate Mortgage (ARM) | Short-term homeowners or those expecting income growth | Lower initial interest rates; rate adjusts after a certain period. | Interest rates and payments can increase over time. |

| Interest-Only Mortgage | Borrowers expecting higher income in the future | Only pay interest for the first few years; lower initial payments. | Higher payments later; not building equity initially. |

| FHA Loans | First-time homebuyers or those with lower credit scores | Lower down payment and credit score requirements. | Requires mortgage insurance premiums (MIP). |

| VA Loans | Eligible veterans and service members | No down payment required; no PMI; limited closing costs. | Must meet service requirements; funding fee. |

Getting the best deal on your home loan

Achieving the best deal on your home loan involves several strategies:

- Improve Your Credit Score: Higher scores often qualify for better interest rates.

- Save for a Larger Down Payment: Reduces the loan amount and can eliminate the need for PMI.

- Shop Around: Compare offers from multiple lenders to find the best rates and terms.

- Negotiate: Don’t be afraid to negotiate terms, especially if you have a strong credit profile.

- Consider Timing: Interest rates fluctuate based on economic factors; sometimes waiting can result in lower rates.

- Use a Mortgage Broker: Brokers can often find better rates and terms due to their network of lenders.

These strategies help find a loan that suits financial situations and goals.

Conclusion

Considering these choices can be complex, but you don’t have to do it alone. We, at AB Realty, have built a wide network and maintained strong relationships with top mortgage brokers that offer top-tier mortgage broker services. With our expertise and wide network of brokers, property lawyers and other industry professionals, we aim to streamline the process, securing you the most favourable terms and conditions. We stand ready to assist you in finding the perfect deal that suits your unique financial situation and achieve smooth property transaction. Let AB Realty guide you toward making your dream of homeownership a reality with personalised, hassle-free service.

Frequently Asked Questions

Is a mortgage broker better than a bank?

When considering a mortgage broker vs a bank, it ultimately depends on your preferences and needs. Mortgage brokers act as intermediaries between you and multiple lenders, offering a variety of loan options. On the other hand, banks are the actual lenders and offer their products.

Mortgage brokers can assist in finding the best rate and loan term tailored to your situation, while banks provide in-house loan products. Working with a mortgage broker may be beneficial if you prefer to have someone navigate the loan process on your behalf, but going directly to a bank offers a more straightforward approach, if you already have the details and already know what you will be dealing with.

How much do mortgage brokers charge in Australia?

The fees charged by mortgage brokers in Australia can vary depending on the broker and the services provided. Mortgage brokers may charge an upfront fee, a commission from the lender, or a combination of both. It’s important to clarify the fee structure with your broker before proceeding with their services to avoid any surprises.

Who pays mortgage broker fees?

Mortgage broker fees are commonly paid by the lender, not the borrower. This commission is usually a percentage of the loan amount and is included in the overall cost of the loan.

Why are some mortgage brokers free?

Some mortgage brokers don’t charge fees directly to borrowers because they receive commissions from lenders when a loan is settled. This means they can offer their services to borrowers at no cost, making their expertise and assistance accessible to a wider range of clients.