-

20+ Years in the Wanneroo Realty Market

20+ Years in the Wanneroo Realty Market -

150+ Managed Properties

150+ Managed Properties -

10,000+ Residential Homes Covered

10,000+ Residential Homes Covered

News

Renting Out Your Property in Perth, WA – Owners Guide

If you’re a property owner in Perth, it might be time to start thinking about renting out your property and becoming a landlord. This is because rental prices across Australia have been soaring, and Perth is no exception!

But becoming a landlord (aka, lessor) is not easy, and there is a lot that you need to consider.

From legal and safety obligations and your responsibilities as a landlord to the decision to get property agents involved or not, there will be a lot on your renting checklist.

This article will take you through a comprehensive guide to renting out your property in Perth, WA, so that you can enter the rental market with full confidence!

Contents

- 1 Making the Decision to Rent out Your Property

- 2 Weekly Rental Analysis for Various Property Types in Perth

- 3 How to Prepare Your Property for Rent

- 4 Steps for Renting Your Property

- 5 Safety and Legal Obligations for Landlords

- 6 What Are Your Ongoing Responsibilities as a Landlord?

- 7 Consider Hiring a Property Agent Instead of Self-Managing Your Rental

Making the Decision to Rent out Your Property

Deciding to lease out your property is easier said than done.

Firstly, whether or not you’ve been living on the property yourself, you’ll need to let go of any emotional attachment that you have to the house. You need to accept that the property is going to be occupied by renters and that you’ll be the one responsible for general upkeep.

Secondly, you’ll need to sit down with a financial advisor and go through all the possible expenses that come with being a landlord. You’ll need to figure out whether renting the property will be a profitable endeavour.

Once you’ve come to a final decision to rent, then you can start going through some of the more technical considerations of becoming a rental landlord.

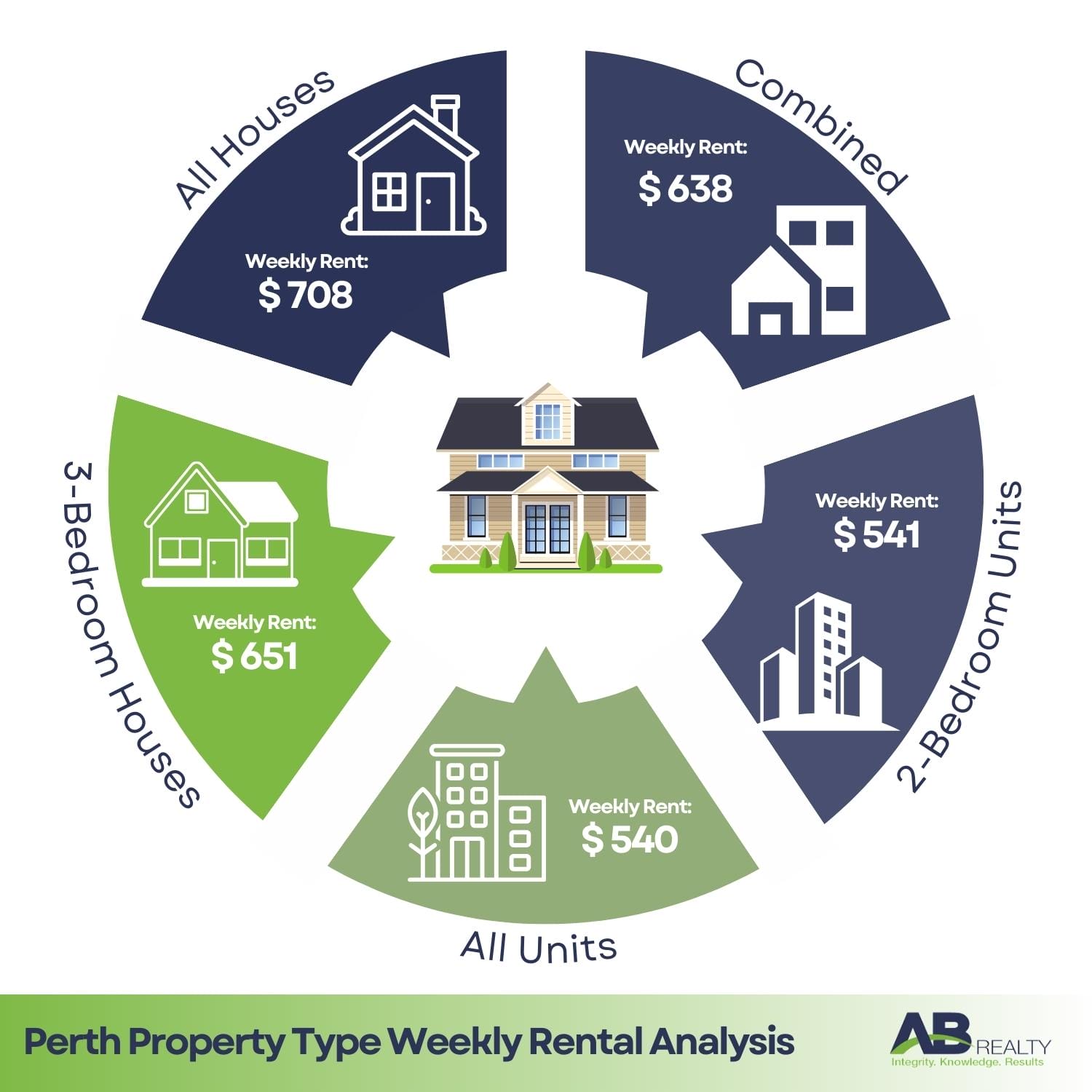

Weekly Rental Analysis for Various Property Types in Perth

The SQM Research Weekly Rents Index for the week ending 4 October 2023, offers a detailed snapshot of the evolving rental landscape in Perth. Let’s delve into the numbers:

| Category | Weekly Rent ($) | Change on prev week ($) | Rolling Month % change | Rolling Quarter % change | 12 Month % change | 3 Year (pa) % change | 7 Year (pa) % change | 10 Year (pa) % change |

| All Houses | 708.45 | -4.45 | -1.2% | 3.3% | 17.5% | 14.4% | 7.3% | 2.2% |

| 3-Bedroom Houses | 651.78 | -2.78 | 0.3% | 6.2% | 15.4% | 14.2% | 6.8% | 2.2% |

| All Units | 540.24 | -1.24 | -1.4% | 2.3% | 18.3% | 14.4% | 6.6% | 1.8% |

| 2-Bedroom Units | 541.70 | -0.70 | 0.8% | 5.0% | 21.4% | 15.5% | 7.2% | 2.3% |

| Combined | 638.05 | -3.10 | -1.3% | 2.9% | 17.8% | 14.4% | 7.1% | 2.0% |

For property owners, this could be a golden era to leverage these bullish rental trends. Property owners will likely reap huge profits from renting out properties, while securing consistent and potentially growing rental income.

How to Prepare Your Property for Rent

Once you’ve decided that you want to rent out your property, it’s time to get it ready for the rental market.

Taking the time to prepare your property will:

- Attract high-quality tenants

- Ensure a higher weekly or monthly rental income

- Make the process of finding tenants faster

But, what can you do to comprehensively prepare your property for the rental market?

1. General Home Maintenance

Before searching for tenants, you must ensure that your property is in tip-top shape. This means going around the entire premises and scanning for anything that needs repairs.

Prospective tenants may look elsewhere if there are additional repairs that need to be done, or if parts of the property aren’t functioning properly.

Common problems that require repairs include:

- Cracked or loose tiles

- Taps that constantly drip

- Broken door locks/locks with no keys

- Mould around the house

- Walls that need new grouting

- Broken windows

- Windows not opening or closing properly

- Chipped or old paint

2. Clean the Property

In addition to handling repairs on the rental property, you should also focus on keeping the house clean and attractive for potential renters.

When tenants arrive at a rental property, cleanliness can build excitement and help them make their decisions faster. Alternatively, an unclean home may quickly drive away prospective renters.

Ensuring that your home is clean when new tenants move in will also set a benchmark for cleanliness that they must match when they eventually move out.

3. Possible Additions to the Property

You may want to include some appliances for your tenants when you decide to rent your property. Furnishing the property with home appliances will increase the appeal of your property, and benefit any occupier massively.

Some appliances you could include:

- Washing machine

- Dishwasher

- Fridge

- Microwave

- Gardening tools (if the property includes a garden)

4. Insurance

You’ll definitely want to invest in full property insurance if you haven’t already. Many landlords also choose to get rental protection insurance (landlord insurance), which covers rental payment losses.

Another way to insure your rental is through a bond, aka, security deposit or security bond. This is not compulsory, however, it is a good idea. This bond will cover any damage to the property, unpaid rent, or other costs that your tenant has to pay at the end of the tenancy.

The security bond comes with its own requirements and regulations, so it can be a bit of extra work, but your agent can handle the entire process. For detailed information on security bonds and bond lodgement, speak to your agent or have a look at the Government of Western Australia’s security bond lodgement form and guidelines.

Steps for Renting Your Property

So, your property is now ready for the rental market. Here are a few steps that you can follow to speed up the process of renting out your property:

- List the property: The best way to list your property is through the Internet. Go around the property, take plenty of photos, and post them to your listing site.

- Screen potential tenants: After you’ve listed your property, prospective tenants will apply and come for viewings. You’ll need to choose the right tenant to lease the home to. You can cross-check tenants’ names using the National Tenancy Database. Likewise, you could also ask the tenant for references (previous landlords or current employer) if you feel that is necessary.

- Draw up a tenancy agreement: Once you’ve selected your preferred tenant, you’ll need to draw up a tenancy agreement. This will contain information like the weekly/monthly rental price, length of tenancy, landlord entry rights, and pet allowances, amongst other things. You’ll also need to consider separate basic needs like water, electricity, and Internet, and whether you’ll provide these. It’s always a good idea to enlist the help of a real estate agency to ensure this step is done correctly.

- Prepare a condition report: You’ll need to prepare a condition report when you hand over the property to your new tenants. This report will contain information about any damage and the overall condition of the property. If you’ve included any electrical appliances in the rental, you should add details on their condition as well. It will also help you check if there has been any new damage when the tenants move out.

Safety and Legal Obligations for Landlords

Each state in Australia has different laws on how landlords can rent out their properties to tenants. Since Perth is situated in Western Australia, here are a few things you must comply with when renting out your home:

- Security, safety, and maintenance rights: This includes rental home upkeep, rent inspections, smoke alarms and RCDs, as well as urgent and non-urgent repairs.

- Notices and complete condition report: This refers to providing property condition reports, as explained above, and other rental forms and notices.

- Safe tenancy regulations: These include the laws that regulate how to handle domestic violence on your rental property and other tenancy issues.

- Types of rental accommodation being provided: These guidelines and regulations explain how to manage different forms of rental agreements. This includes sub-letting, letting as holiday accommodation, granny flat renting, and more.

- Property management: This determines how you should manage your property if you decide to do it yourself, or how to hire a property manager to do the job for you.

For more information on the property rental legislation in Western Australia, have a look at the Government of Western Australia’s housing and accommodation regulations.

What Are Your Ongoing Responsibilities as a Landlord?

The legal responsibilities of an Australian landlord will differ from state to state. However, some responsibilities apply to all homeowners seeking to rent out their property:

- All landlords are responsible for paying the annual rates and council fees for the property.

- All landlords must give tenants 24 hours’ notice before entering the property for any reason.

- Landlords are responsible for ongoing maintenance and repairs to the property. Urgent repairs must be done immediately, and non-urgent repairs must be completed within 14 days of the tenant’s request.

- Landlords are responsible for maintaining the smoke detectors as well as other gas and electrical appliances. This can also include ensuring other safety measures, like fitting a fence around the pool or fixing the locks on the doors.

Consider Hiring a Property Agent Instead of Self-Managing Your Rental

So, you now know everything you need to know about renting out your property in Perth, WA. There are a lot of obligations and responsibilities for landlords to adhere to, and it could take up a lot of your time if you decide to rent privately.

You’ll also need to determine your property’s worth, ensure you abide by the correct laws and minimum standards, as well as find and screen the tenants yourself.

If you want a hassle-free real estate management agency to do all of this for you, check out AB Realty today! At AB Realty, we work for you, the landlord. We’ll make your rental ventures easy by managing multiple tasks, including:

- Listing and advertising your property

- Opening your property for prospective tenant viewing

- Thorough tenant screening processes

- Handling any tenant disputes

- Preparing documentation including the residential tenancy agreement

- Ensuring rental payments

- Handling all tenant complaints

- Property maintenance

Contact AB Realty today and get in touch with one of our experienced estate agents!

Additional Resources

Government of Western Australia’s Lessor’s Guide

Government of Western Australia’s Rent Agreement (Form 1AA)