-

20+ Years in the Wanneroo Realty Market

20+ Years in the Wanneroo Realty Market -

150+ Managed Properties

150+ Managed Properties -

10,000+ Residential Homes Covered

10,000+ Residential Homes Covered

News

Are Apartments a Good Investment?

Yes, you will find apartments to be a good investment in Australia’s real estate market, thanks to their capital growth potential and attractive rental yields. This stems from expanding cities and the demand for modern living spaces, making apartments as a key investment choice.

Your decision to invest should include analysing location, market trends, and financial metrics to identify properties that offer high rental income and appreciation potential. Apartments also improves your portfolio by adding in more variety, reducing your investment risks and providing a practical investment opportunity, especially when that includes hiring an excellent property manager in Perth.

Contents

Why Consider Investing in Apartments?

Investing in apartments offers a strategic entry into Australia’s real estate market, with capital growth and strong rental yields. It’s appealing because it addresses the housing needs of the growing urban population, giving you a tangible asset that benefits from supply and demand economics.

Choosing apartments in high-demand areas ensures steady rental income and potential value appreciation, making them important for diversified portfolios. Additionally, choosing to invest in apartments than other properties includes the benefit of lower maintenance costs and shared amenities, which will suit with the renter’s preferences and will contribute to the stability of rental yield.

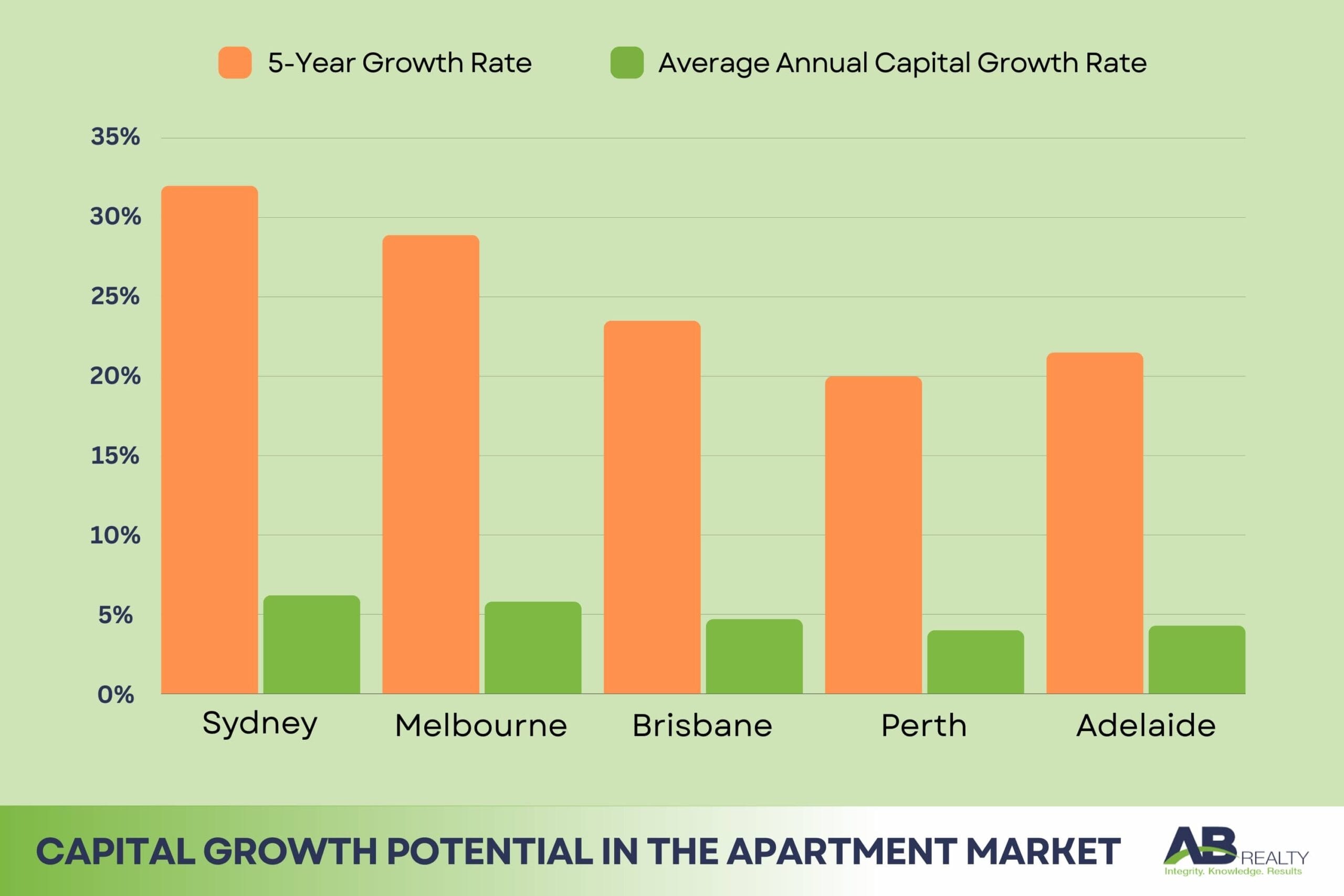

Capital Growth Potential in the Apartment Market

The apartment market in Australia holds substantial capital growth potential, appealing if you’re aiming to enhance your portfolio’s value. This property market growth is fuelled by urban development and the increasing demand for residential spaces in city centres.

Choosing strategically located apartments, close to amenities and transport, is likely to appreciate in value due to economic and demographic changes in Australia’s urban areas.

| City | Average Annual Capital Growth Rate | 5-Year Growth Rate |

| Sydney | 6.2% | 32.0% |

| Melbourne | 5.8% | 28.9% |

| Brisbane | 4.7% | 23.5% |

| Perth | 4.0% | 20.0% |

| Adelaide | 4.3% | 21.5% |

Data sourced from Australian Property Market Reports

Rental Yields and Investment Returns for Apartments

Apartments provide appealing rental yields, leading to consistent investment returns. Their desirability among urban workers and smaller households ensures continuous demand, boosting your potential rental income should you choose to invest. This steady income, alongside the potential for long-term capital growth, makes apartments an attractive choice for immediate cash flow and future financial benefits.

| Region | Average Rental Yield |

| Sydney CBD | 5.0% |

| Melbourne CBD | 5.5% |

| Brisbane CBD | 5.2% |

| Perth CBD | 4.8% |

| Adelaide CBD | 5.1% |

Data sourced from Australian Rental Market Reports

Factors to Consider When Buying an Apartment for Investment

When considering an investment in apartments, you should focus on the property location, market trends, economic indicators, legal and regulatory environment, mortgage options, tax implications, and strata fees.

Choosing properties in high-demand areas and being familiar with financial details are crucial for a comprehensive investment evaluation, enabling you to make informed decisions within Australia’s dynamic apartment market.

| Factor | Consideration Details |

| Location | Proximity to amenities, transport, employment sectors |

| Market Trends | Supply and demand dynamics, demographic shifts |

| Economic Indicators | Interest rates, employment rates, GDP growth |

| Legal and Regulatory Environment | Tenancy laws, strata regulations, zoning laws |

| Financial Details | Mortgage options, tax implications, strata fees |

Consideration Checklist for Apartment Investment

Apartment vs House: Which is a Better Investment?

Your choice between an apartment and a house investment will depend on your investment objectives and the advantages each property type offers.

Apartments may present lower entry costs and higher rental yields, especially appealing in urban areas, while houses might offer long-term capital appreciation and modification opportunities. Your choice lies on the financial strategy, risk appetite, and market insight, with apartments providing quick returns and houses offering long-term growth benefits.

Comparing Rental Yields and Capital Growth in Apartments and Houses

| Property Type | Average Rental Yield | 5-Year Capital Growth Rate |

| Apartments | 5.0% – 5.5% | 25% – 30% |

| Houses | 3.5% – 4.0% | 30% – 35% |

Data sourced from Australian Real Estate Market Reports

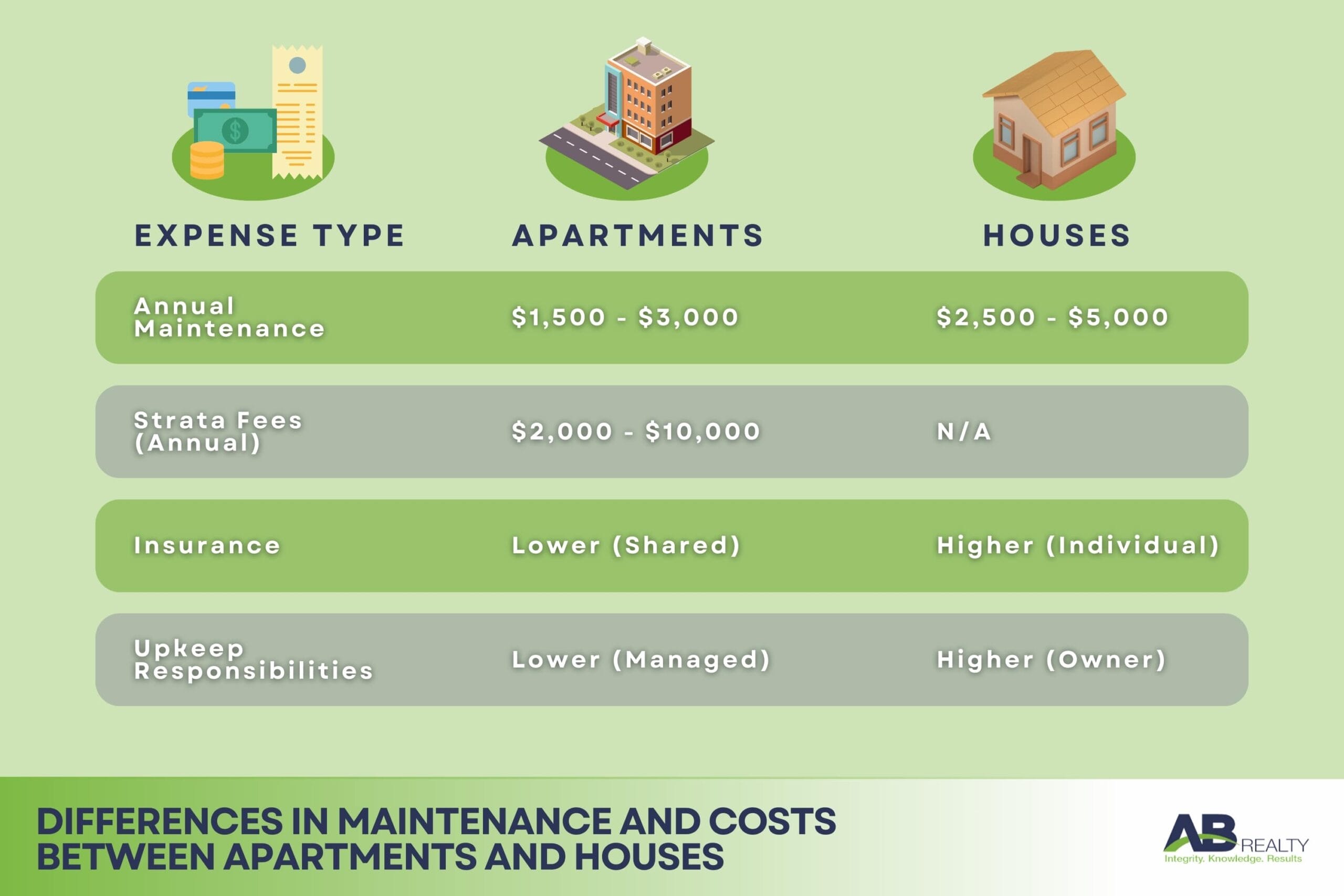

Differences in Maintenance and Costs Between Apartments and Houses

| Expense Type | Apartments | Houses |

| Annual Maintenance | $1,500 – $3,000 | $2,500 – $5,000 |

| Strata Fees (Annual) | $2,000 – $10,000 | N/A |

| Insurance | Lower (Shared) | Higher (Individual) |

| Upkeep Responsibilities | Lower (Managed) | Higher (Owner) |

Data sourced from Australian Property Maintenance Services

Long-Term Value Appreciation of Apartments vs Houses

Generally, houses show higher long-term value appreciation compared to apartments, primarily due to the land value. Over the past decade, houses in key Australian cities have consistently appreciated more in value than apartments, which depend on the building’s condition and unit demand.

Factors to Consider Before Investing in Apartments

Before you invest in apartments, you should consider location, market trends, financial considerations, legal and regulatory frameworks, and property condition. Properties in high-demand areas with good infrastructure will definitely show better rental yields and capital growth. Understanding financial details and property management aspects is essential for aligning your investments with your financial goals in Australia’s apartment market.

Location and Suburb Analysis for Apartment Investment

| Suburb | Accessibility | Amenities | Historical Appreciation Rates | Notes |

| Surry Hills, Sydney | High | Excellent | 5% annually | Vibrant community, close to CBD |

| Southbank, Melbourne | High | Excellent | 4.8% annually | Arts precinct, river views |

| Newstead, Brisbane | Moderate | High | 4.5% annually | Rapidly developing area |

Data sourced from Australian Property Market Reports

See also our article about top 10 Perth suburbs for property investments.

Understanding the Property Market Trends for Apartment Investing

| Trend | Impact on Apartment Investing |

| Urbanisation | Increases demand in city centres, boosting rental yields |

| Demographic Shifts | Smaller household sizes increase demand for apartments |

| Economic Policies | Interest rate changes can affect investment viability |

Insights sourced from Australian Economic Reports

Financial Considerations such as Rental Yield and Appreciation for Investors

| Cost Type | Initial Costs | Ongoing Expenses | Projected Returns |

| Apartment in Sydney CBD | $500,000 | $30,000 annually | 5% rental yield |

| Apartment in Melbourne CBD | $400,000 | $25,000 annually | 5.5% rental yield |

| Apartment in Brisbane CBD | $350,000 | $22,000 annually | 5.2% rental yield |

Examples of financial modelling for apartment investments

Benefits of Apartment as Property Investment

Investing in apartments offers benefits like steady rental income, capital appreciation potential, ease of management, and reduced maintenance costs. The high demand in urban centres ensures a solid tenant base, contributing to consistent rental yields and financial advantages, making apartments an attractive investment choice in Australia’s real estate market.

Diversification Opportunities in Apartment Buildings and Complexes

Investing in apartment buildings and complexes provides diversification opportunities, spreading risk across multiple units and tenant demographics. This strategy will stabilise your income, with vacancies in one unit offset by occupied units, allowing you to leverage different market settings for an optimal investment balance.

Managing Rental Properties and Dealing with Tenants in Apartments

Effective rental property management and tenant relations are important for maximising the value of your apartment investment. Proper management maintains property appeal, supports high occupancy rates, and optimise the overall rental income. Getting professional property management services will ensure compliance and efficient operation of your rental apartments significantly that we highly recommend it. For further information, we have created a dedicated article for Tenant’s Rights and Guide to Repairs to Rental Property.

Strata Fees, Amenities, and Body Corporate Factors for Apartment Owners

Understanding strata fees, amenities, and body corporate regulations is essential for you as an apartment investor. Strata fees impact net returns, while amenities can attract tenants and justify higher rents. Balancing the benefits of amenities against ongoing costs and body corporate obligations is key to achieving favourable investment outcomes.

Conclusion

Investing in apartments in Australia is a smart move for those looking to grow their money and earn steady rental income. It’s important to carefully pick the right location and understand the market and financial aspects to find properties that will bring in good rental money and increase in value. Apartments are not just about providing homes in busy cities; they also offer lower upkeep costs and help spread out investment risks.

If you’re thinking about getting into the apartment rental business, it’s an excellent idea to hire a property manager. We, at AB Realty, can take care of the day-to-day management, making sure your property is well-looked after and your renters are happy. This way, you can enjoy the benefits of your investment without the hassle, and keep your focus on making more smart investment choices.